Happiness Reset, a recap

If you’ve already read the previous articles in this series, you’ll know that we recently launched our 2021 Culture + Trends Report: Happiness Reset. It’s based on a three-part proprietary study we conducted at the end of 2020, which captures 14 consumer trends that define the post-2020 consumer.

In the previous article, you can read in detail about the methodology, as well as how we define the post-2020 consumer in Asia. In this article, I’ll focus on consumers in the US, with a deep-dive into the data, and some examples of brands that are already tapping into the opportunities that the 14 trends present.

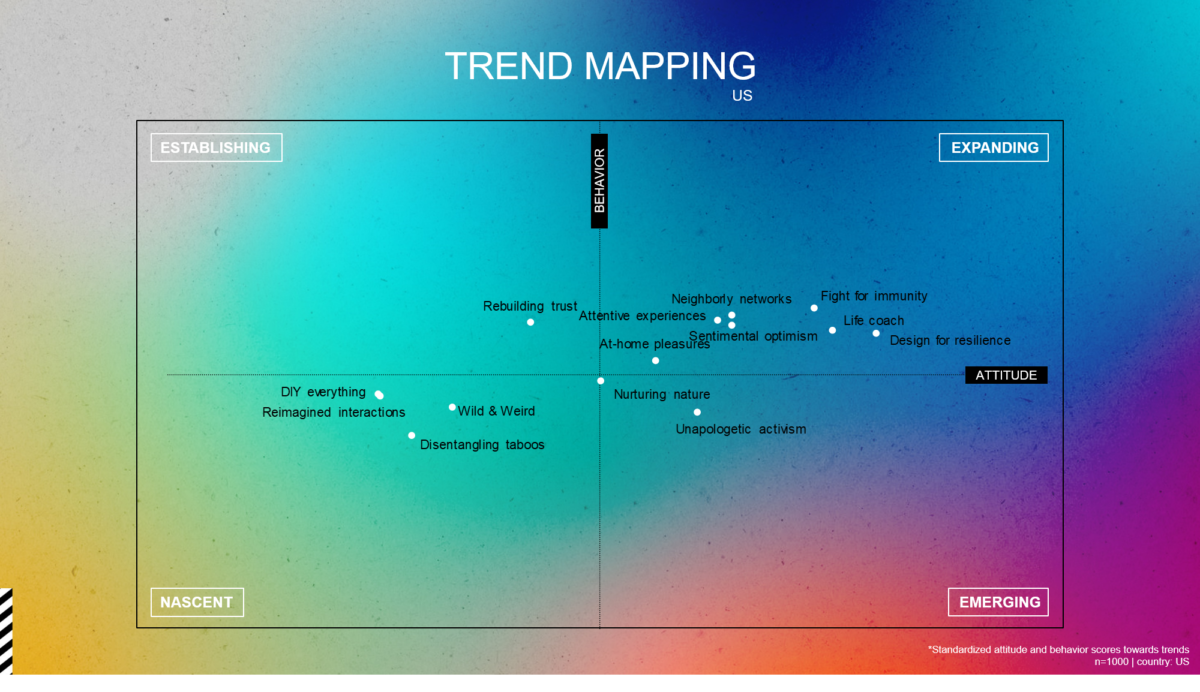

Broadly speaking, what we found in our report was that the events of 2020 have shaped how consumers in the US, and globally, seek and attain happiness. This ‘reset’, as we have coined it, is driving new behavior and expectations towards brands. Acting as a catalyst for behavioral change, the pandemic is at the centre of this, accelerating slow-moving macro trends as well as creating entirely new ones. By measuring consumers’ attitudes towards the 14 trends we identified, as well as how they are acting upon the trends when buying brands, we’re able to report trend scores and a global trend mapping.

So, how what characterizes the post-2020 consumer in the US?

Defining the post-2020 consumer in the US

Whilst we saw that 13 of the 14 trends scored higher with consumers in Asia compared to the rest of the world, we see the opposite in the US, where all 14 trends score somewhat lower than they do globally. Whilst the trend score considers attitude and/or behavior, there clearly is a greater spread in the attitude of consumers in the US more so than behaviour.

This difference in attitude is most prominent for a handful of our trends, the most extreme being ‘Nurturing Nature’, where we see that having experienced a new immediacy with nature, consumers are realizing its importance for better physical and mental wellbeing. Consumers that identify with this trend state that they “need to be physically close to nature in order to feel well”. Interestingly, we see a drop in both attitude and behaviour towards this trend in the US compared to consumers globally, moving the trend from the Expanding quadrant to the border of Nascent and Emerging. This trend has a score of 64% in the US, in comparison to a global score of 76%. Whilst it is easy to disregard a Nascent trend as too niche for brands to concern themselves with, it’s important to note that these trends actually have the potential to grow. Global furniture brand IKEA is already tapping into this trend with their Fortune Favours the Frugal campaign, which shows that simple everyday solutions in the home, such as growing herbs and reusing water, can have a big, positive impact on the planet.

Similarly, we see a lower level of identification (attitude) with the trend ‘DIY Everything’ amongst US consumers than globally. Consequently, the trend has a score of 55% in the US, compared to 61% globally. This trend comes from the desire for individuality and a shift towards sustainable living, which is driving the uptake of do-it-yourself formats. Consumers that identify with it state that they “want to make and modify things themselves, rather than buy them off the shelf”. ‘DIY Everything’ sits in the Nascent quadrant at both global and US level when we look at the general population. However, if we only look at NextGen consumers in the US, combining Gen Z and Millennials in this category, ‘DIY Everything’ sits in the Expanding quadrant. The trend score amongst this group is higher, at 71%. This is likely because NextGen consumers are actively looking for daily activities that provide structure and distraction from the boredom of the pandemic restrictions. They are looking for new hobbies and crafts, from learning a new language to courses in cooking or coding. Joeri Van den Bergh, co-founder and NextGen expert, explains: “This trend is driven by an increased need for expressing individuality, along with a strong shift towards more sustainable living. The pandemic has definitely accelerated both needs, as consumers in general, and especially the younger ones, are re-evaluating their ‘ikigai’ (a Japanese concept that means ‘a reason for being’). DIY offers control over ingredients used or processing methods, as well as the carbon footprint, while the active engagement in new skills gives a sense of purpose and achievement.”

We see the opposite of this with ‘Neighborly Networks’, a trend which has been accelerated by the pandemic, causing consumers to recognize the value of community ties to their social lifestyles. Consumers that identify with this trend state that they “feel responsible for actively supporting the people and businesses in their local community”. It brings a significant increase in attitude for those in the US compared to globally, whilst remaining at a similar level of behaviour. As an Expanding trend in the US, it’s not surprising that we already see brands answering this need. Streetwear brand Neighborhood Spot was set up to support iconic New York businesses such as Ray’s Candy Store. In addition to selling merchandise, it also holds a monthly Rent Relief Lottery. Angie Deceuninck, Managing Director of our US office, adds: “A great example of this trend in action is the Shop Small initiative from American Express. The financial services provider launched the Shop Small campaign to shine a light on small businesses across the US by sharing the stories of business owners on the American Express website, in order to encourage communities to shop at small, local businesses. The brand also provides a Shop Small Map to help consumers achieve this goal.”

The role of brands

All trends present opportunities for brands to play in this space; those which might be Nascent at the moment could grow in the coming months to become Emerging; they would thus open up space for brands that can offer products and services that allow consumers to act upon the relevant need.

As a rough guide, brands tapping into the ‘Nurturing Nature’ trend should focus on unadulterated ingredients, alternative materials, and services that support enjoyment of the great outdoors in ways that make a positive impact on people- and planet-health. For those dipping a toe in the ‘DIY Everything’ trend, platforms and solutions should be created that inspire consumers to creatively express themselves on their own terms through maker collaborations, DIY recipes, self-serve apps and cross-category competitions that tap into DIY entrepreneurship. Finally, brands can navigate the ‘Neighborly Networks’ trend space with partnerships or upskilling schemes that actively support specific communities and small businesses.

Again, this is just the tip of the iceberg of how we can define the post-2020 consumer in the US, with much more data and insights available in our full report. In our final article, we’ll deep dive into consumers in Europe, exclusively for Research World.